Facts About Custom Private Equity Asset Managers Revealed

You've possibly listened to of the term private equity (PE): buying companies that are not openly traded. Approximately $11. 7 trillion in properties were managed by private markets in 2022. PE companies look for opportunities to click to read more earn returns that are far better than what can be achieved in public equity markets. But there may be a couple of things you don't recognize regarding the industry.

Exclusive equity companies have a range of investment choices.

Due to the fact that the most effective gravitate toward the bigger bargains, the center market is a substantially underserved market. There are extra vendors than there are highly skilled and well-positioned money experts with considerable customer networks and resources to handle a deal. The returns of private equity are commonly seen after a couple of years.

Rumored Buzz on Custom Private Equity Asset Managers

Traveling listed below the radar of huge multinational corporations, much of these little firms commonly give higher-quality customer care and/or particular niche services and products that are not being provided by the large empires (https://www.goodreads.com/user/show/172190636-madge-stiger). Such advantages bring in the rate of interest of personal equity firms, as they have the insights and savvy to exploit such opportunities and take the firm to the following level

A lot of supervisors at portfolio companies are offered equity and incentive payment structures that award them for hitting their monetary targets. Private equity possibilities are usually out of reach for people who can't spend millions of dollars, yet they shouldn't be.

There are guidelines, such as restrictions on the aggregate quantity of cash and on the number of non-accredited investors (Private Equity Firm in Texas).

Not known Facts About Custom Private Equity Asset Managers

An additional drawback is the absence of liquidity; when in a personal equity transaction, it is not very easy to get out of or offer. With funds under management currently in the trillions, private equity companies have become eye-catching investment lorries for affluent people and establishments.

Now that access to private equity is opening up to more individual financiers, the untapped capacity is ending up being a fact. We'll start with the main arguments for investing in personal equity: Exactly how and why personal equity returns have actually traditionally been higher than other assets on a number of levels, Just how including private equity in a profile affects the risk-return profile, by helping to diversify against market and cyclical threat, Then, we will detail some crucial factors to consider and risks for personal equity financiers.

When it pertains to presenting a brand-new possession into a portfolio, the many fundamental factor to consider is the risk-return account of that property. Historically, private equity has actually shown returns similar to that of Emerging Market Equities and greater than all various other standard asset courses. Its reasonably reduced volatility paired with its high returns produces a compelling risk-return profile.

The Ultimate Guide To Custom Private Equity Asset Managers

Exclusive equity fund quartiles have the widest array of returns throughout all alternative property classes - as you can see below. Technique: Interior price of return (IRR) spreads out calculated for funds within classic years individually and afterwards balanced out. Typical IRR was calculated bytaking the standard of the mean IRR for funds within each vintage year.

The result of including personal equity into a profile is - as always - reliant on the portfolio itself. A Pantheon research from 2015 recommended that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best exclusive equity companies have access to an even larger pool of unknown possibilities that do not encounter the exact same analysis, along with the sources to do due diligence on them and determine which deserve buying (Private Equity Firm in Texas). Spending at the ground flooring means higher danger, however, for the companies that do be successful, the fund take advantage of greater returns

Custom Private Equity Asset Managers for Beginners

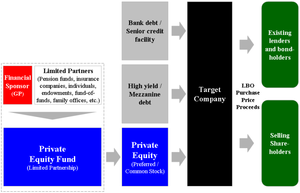

Both public and exclusive equity fund managers dedicate to investing a percent of the fund but there remains a well-trodden problem with straightening interests for public equity fund management: the 'principal-agent issue'. When a capitalist (the 'primary') hires a public fund supervisor to take control of their resources (as an 'representative') they entrust control to the manager while preserving ownership of the properties.

In the instance of private equity, the General Companion doesn't simply make a management cost. Exclusive equity funds likewise minimize another kind of principal-agent issue.

A public equity financier inevitably desires one thing - for the management to increase the supply rate and/or pay out dividends. The investor has little to no control over the decision. We revealed above just how numerous private equity techniques - particularly bulk buyouts - take control of the running of the business, making sure that the long-term worth of the firm precedes, rising the roi over the life of the fund.